TAX RATE INFORMATION

TRUTH IN TAXATION HISTORY

NOTICE OF TAX RATES AND WORKSHEETS

VEHICLE INVENTORY TAX (VIT) AND HEAVY EQUIPMENT TAX RATES

CERTIFIED ROLL TOTALS, TAX ROLL TOTALS – ALL ENTITIES

BUSINESS PERSONAL PROPERTY

CAPITALIZATION RATES

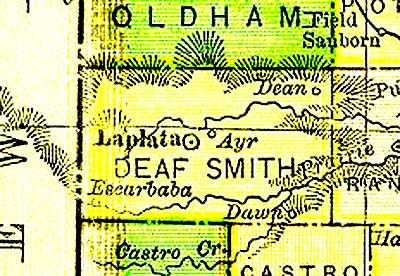

- The Deaf Smith County Appraisal District’s CAP RATE for income producing property is 10%.

- For property that qualifies for an exemption under Sec. 11.1825 of the Texas Property Tax code concerning an Organization constructing or rehabilitating low-income housing – The capitalization rate will be 13%.

TAX SALES – Tax Sales are handled by Purdue, Brandon, Fielder, Collins, and Mott law firm. Please go to their website for more information.